Recently, BP ruled itself out from drilling shale gas in the UK because it may “attract the wrong kind of public attention” [1]. In 2013 new studies estimated huge shale potential in the United Kingdom, as much as 1,000 trillion cubic feet of shale gas. However, despite the strong push from Prime Minister David Cameron, public aversion for shale exploration keeps growing; and so does Europe’s need to increase its energy independence from Russia.

Today, European gas supplies are threatened by the Crimea crisis, only a couple of years after the 2009 pricing disputes between Ukraine and Russia. The significant shortages that exposed Europe’s vulnerability at the time, led the European Union to seek further supply diversification, e.g. though the development of the Trans-Adriatic Pipeline [2]. Today, Russian imports are down to 30% of its total natural gas consumption [3], from 40% in 2009. However, countries as Bulgaria, still rely for nearly 90% of their gas consumption on Russia [4].

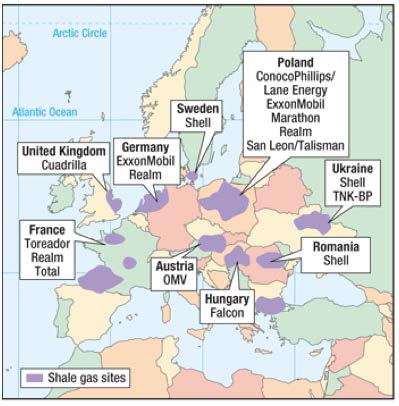

Europe possesses enough wet shale gas, about 470 trillion cubic feet, to satisfy decades of demand [4] according to the EIA [5]. Nevertheless, it remains much more cautious in untapping these resources than the US. Europe not only seeks to balance the implications of shale gas developments on its energy security, but also on its environmental footprint and its economic growth. At the HIS CERAWeek energy conference, the CEO of Siemens, raised his concern that Europe may risk to get “left behind by manufacturers” if it doesn’t produce its shale gas.

DISCUSSION: Is shale gas the answer to Europe’s dependence on Russia and at what cost? What is the price of keeping Europe’s shale gas in the ground?

Written by: Middoni Ramos/ Celine Rottier

- http://www.theguardian.com/business/2014/feb/04/bp-shale-gas-drilling

- http://oilprice.com/Geopolitics/Europe/Trans-Adriatic-Pipeline-Enhances-European-Energy-Security.html

- http://www.forbes.com/sites/christopherhelman/2014/03/03/what-ukraine-needs-is-an-american-style-shale-gas-revolution/

- http://www.bloomberg.com/news/2013-09-26/bulgaria-seeks-to-cut-russia-gas-imports-to-ensure-supply.html

- http://www.eia.gov/analysis/studies/worldshalegas/pdf/table3.pdf

- http://www.bloombergview.com/articles/2014-02-18/fracking-doesn-t-threaten-russian-power

Categories: Discussion - Oil & Gas, Energy

Aside from complicated geology, the main impediments for shale gas development in EU, are weak political will and unfavourable fuel/project economics. Both EU’s total gas consumption and imports have been falling in the past 3 years. One example is more and more LNG has been reloaded to Asia from countries like Spain, Belgium and France. Reasons for weaker gas demand in EU include availability of cheap U.S coal, collapsed prices of carbon allowance, and the scaling up of renewables. Bearish gas markets, coupled with strong public opposition, has posed considerable challenges for EU’s shale gas development. However, other than boosting shale production, there’re other measures that EU can take to reduce its reliance on Russia. The cost of not having indigenous shale production lies in the pain EU has to take in diversifying gas supplier( Algeria, Nigeria, Norway, Netherlands or even East Africa), using Spanish gas to balance, developing internal interconnections, and further liberalizing gas and carbon markets, all of which EU should have already been doing. The tangible costs could be exposure to higher prices of spot gas/LNG and the cost of improving infrastructure and efficiency measurements. In the short to medium term, EU probably has to rely on Russia as a key supplier and vice versa. But it’s high time that EU start to really take substatial and (very likely) painful measures in reducing its reliance, given the fact that Russian has been increasingly looking to sell its gas to the East and developing liquified natural gas projects.